All Categories

Featured

Table of Contents

Variable annuities are a sort of financial investment earnings stream that climbs or drops in value periodically based on the market efficiency of the investments that money the revenue. An investor that chooses to produce an annuity may choose either a variable annuity or a taken care of annuity. An annuity is an economic product provided by an insurance provider and available with financial establishments.

Annuities are most typically used to create a regular stream of retired life earnings. The taken care of annuity is a different to the variable annuity. A set annuity develops the amount of the payment beforehand. The value of variable annuities is based upon the efficiency of a hidden profile of sub-accounts chosen by the annuity proprietor.

Fixed annuities offer an assured return. Variable annuities use the opportunity of greater returns but additionally the risk that the account will fall in worth. A variable annuity is produced by a agreement contract made by a capitalist and an insurer. The capitalist makes a swelling sum payment or a series of repayments gradually to fund the annuity, which will start paying at a future day.

The settlements can continue for the life of the investor or for the life of the capitalist or the capitalist's making it through partner. It additionally can be paid in an established number of payments. Among the other significant decisions is whether to prepare for a variable annuity or a dealt with annuity, which sets the quantity of the repayment ahead of time.

Sub-accounts are structured like mutual funds, although they do not have ticker symbols that investors can easily use to track their accounts.

Typically utilized for retirement preparation objectives, it is meant to supply a normal (regular monthly, quarterly, or yearly) revenue stream, starting at some point in the future. There are prompt annuities, which start paying income as quickly as the account is completely moneyed. You can buy an annuity with either a swelling amount or a series of settlements, and the account's worth will expand in time.

Highlighting the Key Features of Long-Term Investments A Closer Look at Fixed Vs Variable Annuities What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Fixed Annuity Vs Variable Annuity Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Choosing Between Fixed Annuity And Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Or Variable Annuity A Closer Look at How to Build a Retirement Plan

The 2nd phase is activated when the annuity owner asks the insurance provider to begin the flow of earnings. Variable annuities need to be considered long-term financial investments due to the constraints on withdrawals.

Variable annuities were presented in the 1950s as a choice to taken care of annuities, which provide a guaranteedbut typically lowpayout during the annuitization phase. (The exemption is the fixed income annuity, which has a moderate to high payout that rises as the annuitant ages). Variable annuities like L share annuities offer financiers the chance to raise their annuity income if their investments grow.

The upside is the opportunity of higher returns during the build-up phase and a bigger revenue throughout the payout stage. With a dealt with annuity, the insurance coverage company presumes the threat of delivering whatever return it has actually assured.

a few other type of financial investment, it deserves weighing these benefits and drawbacks. Pros Tax-deferred development Revenue stream tailored to your requirements Ensured death advantage Funds off-limits to lenders Disadvantages Riskier than fixed annuities Give up charges and fines for early withdrawal High charges Below are some information for each side. Variable annuities expand tax-deferred, so you do not have to pay taxes on any financial investment gains up until you begin receiving revenue or make a withdrawal.

You can tailor the revenue stream to fit your requirements. Variable annuities are riskier than repaired annuities due to the fact that the underlying financial investments might lose worth.

Any type of withdrawals you make before age 59 may go through a 10% tax fine. The fees on variable annuities can be fairly large. An annuity is an insurance policy product that ensures a series of repayments at a future day based on a quantity deposited by the financier. The issuing business invests the cash up until it is disbursed in a collection of settlements to the investor.

Analyzing Variable Annuity Vs Fixed Indexed Annuity Key Insights on Your Financial Future Defining Annuities Fixed Vs Variable Benefits of Fixed Vs Variable Annuities Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Explained in Detail Key Differences Between Fixed Interest Annuity Vs Variable Investment Annuity Understanding the Key Features of Fixed Index Annuity Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Deferred Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Deferred Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at Fixed Interest Annuity Vs Variable Investment Annuity

Annuities typically have higher fees than a lot of mutual funds. There is no clear solution to this. Variable annuities have greater potential for profits development yet they can additionally lose cash. They likewise have a tendency to be riddled with costs, which reduces into revenues. Fixed annuities generally pay out at a reduced however stable rate compared to variable annuities.

No, annuities are not guaranteed by the Federal Deposit Insurance Policy Corp. (FDIC) as they are not bank products. They are secured by state warranty organizations if the insurance policy company providing the product goes out of organization. Prior to acquiring a variable annuity, financiers should carefully check out the program to recognize the expenditures, threats, and formulas for determining financial investment gains or losses.

Keep in mind that between the numerous feessuch as investment management costs, mortality fees, and management feesand charges for any kind of additional bikers, a variable annuity's costs can rapidly accumulate. That can adversely influence your returns over the long term, compared with other kinds of retirement investments.

That relies on the efficiency of your investments. Some variable annuities supply alternatives, referred to as bikers, that enable stable payments, instead than those that vary with the marketwhich seems a whole lot like a fixed annuity. Yet the variable annuity's underlying account equilibrium still changes with market performance, perhaps impacting just how long your payments will certainly last.

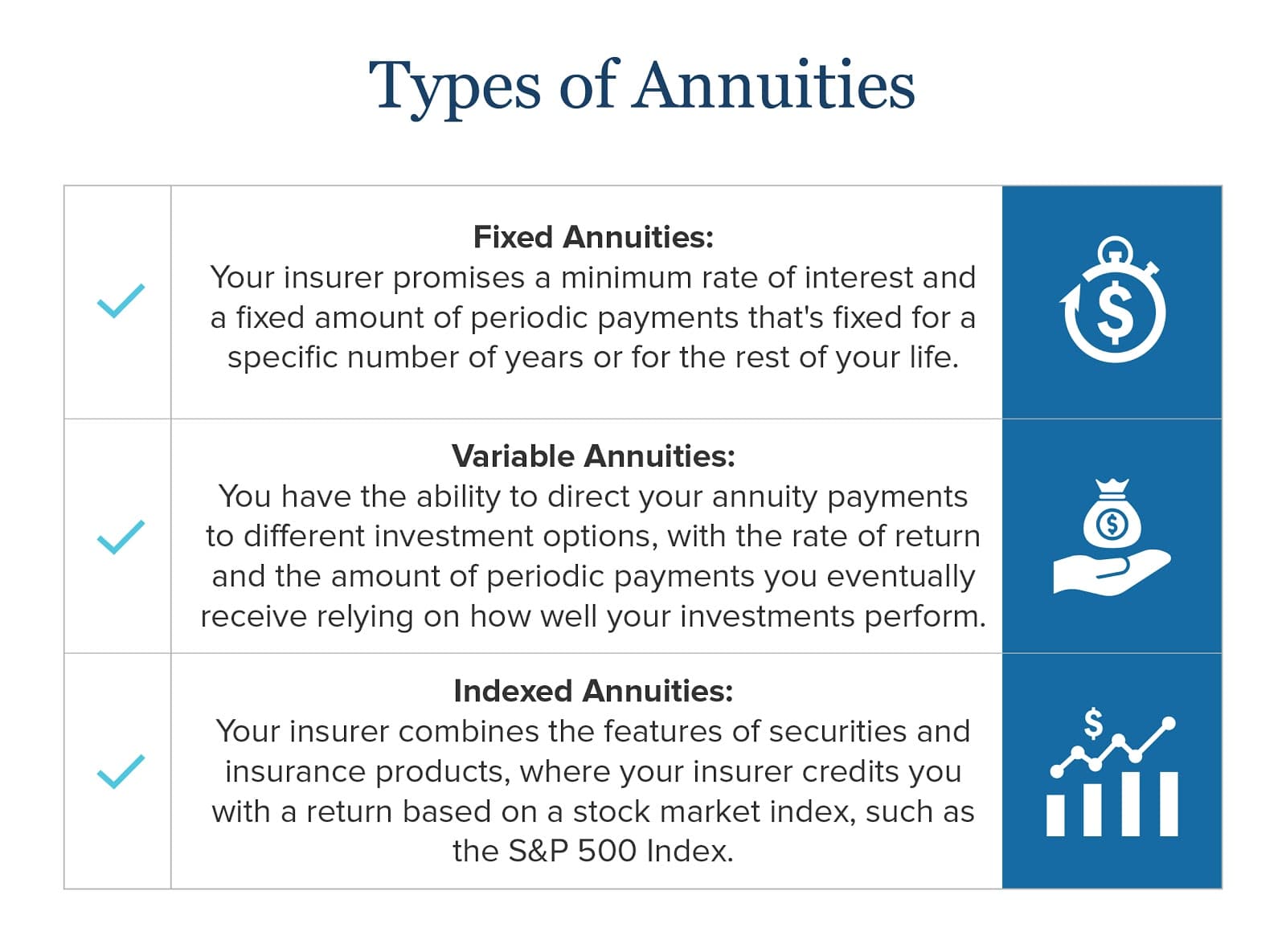

There are two major kinds of annuities: dealt with and variable. The main distinction between them is the quantity of danger assumed to achieve your preferred rate of return. Variable annuities will certainly lug even more risk, while taken care of annuities usually supply affordable rate of interest prices and restricted threat. Annuities use development opportunities, fund flexibility, and the choice for guaranteed life time revenue.

American Integrity ensures both the principal and passion on our taken care of contracts and there is an ensured minimum interest rate which the agreement will never ever pay less than, as long as the contract is in pressure. This agreement allows the potential for greater returns on financial investments over the lengthy term by permitting the owner the capability to buy various market-based portfolios.

Breaking Down Your Investment Choices A Comprehensive Guide to Fixed Vs Variable Annuity Breaking Down the Basics of Variable Annuities Vs Fixed Annuities Pros and Cons of Various Financial Options Why Variable Vs Fixed Annuities Is a Smart Choice Annuities Fixed Vs Variable: Explained in Detail Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Risks of Fixed Index Annuity Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at What Is A Variable Annuity Vs A Fixed Annuity

At The Annuity Expert, we understand the complexities and emotional anxiety of planning for retired life., and retired life coordinator.

Whether you are risk-averse or seeking greater returns, we have the experience to assist you with the nuances of each annuity type. We acknowledge the stress and anxiety that comes with financial unpredictability and are right here to provide quality and confidence in your financial investment decisions. Start with a complimentary examination where we evaluate your economic goals, threat resistance, and retired life demands.

Shawn is the owner of The Annuity Specialist, an independent online insurance firm servicing customers across the USA. Through this system, he and his group aim to get rid of the uncertainty in retirement preparation by assisting people locate the most effective insurance policy coverage at the most affordable rates. Scroll to Top.

This costs can either be paid as one lump sum or dispersed over a duration of time., so as the worth of your contract expands, you will certainly not pay taxes up until you get income payments or make a withdrawal.

Decoding Indexed Annuity Vs Fixed Annuity Everything You Need to Know About Financial Strategies Defining Variable Vs Fixed Annuity Benefits of Fixed Income Annuity Vs Variable Growth Annuity Why Variable Annuities Vs Fixed Annuities Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Variable Annuity Vs Fixed Indexed Annuity FAQs About Fixed Vs Variable Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Annuity Vs Equity-linked Variable Annuity A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at How to Build a Retirement Plan

Regardless of which choice you make, the cash will certainly be rearranged throughout your retired life, or over the duration of a selected time duration. Whether a swelling sum payment or several costs payments, insurance provider can offer an annuity with a set rates of interest that will certainly be credited to you gradually, according to your contract, referred to as a set rate annuity.

As the value of your fixed rate annuity grows, you can proceed to live your life the method you have actually constantly had prepared. There's no demand to tension over when and where money is coming from. Settlements are regular and assured. Make sure to talk to your monetary consultant to determine what type of fixed price annuity is best for you.

This gives you with assured earnings earlier instead of later on. You have choices. For some the immediate alternative is a needed option, but there's some versatility below also. While it may be used immediately, you can additionally postpone it for approximately one year. And, if you postpone, the only section of your annuity considered taxable revenue will be where you have actually accrued rate of interest.

A deferred annuity allows you to make a round figure repayment or a number of repayments with time to your insurer to provide income after a set duration. This period permits the passion on your annuity to grow tax-free before you can accumulate payments. Deferred annuities are normally held for about two decades before being eligible to get payments.

Decoding Variable Vs Fixed Annuities Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at How to Build a Retirement Plan

Because the interest rate is dependent upon the efficiency of the index, your cash has the chance to grow at a different rate than a fixed-rate annuity. With this annuity strategy, the rate of interest will never be less than zero which implies a down market will not have a substantial adverse effect on your income.

Simply like all financial investments, there is potential for threats with a variable rate annuity.

Table of Contents

Latest Posts

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Benefits of What Is Variable Annuity Vs

Exploring the Basics of Retirement Options Everything You Need to Know About Variable Annuity Vs Fixed Indexed Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why Ch

Breaking Down Your Investment Choices A Comprehensive Guide to What Is A Variable Annuity Vs A Fixed Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Choosing Between Fixed

More

Latest Posts