All Categories

Featured

Table of Contents

- – Analyzing Fixed Vs Variable Annuity Pros Cons ...

- – Understanding Fixed Income Annuity Vs Variable...

- – Exploring the Basics of Retirement Options A ...

- – Highlighting Fixed Interest Annuity Vs Variab...

- – Breaking Down Your Investment Choices A Clos...

- – Analyzing Strategic Retirement Planning Key ...

- – Analyzing Fixed Index Annuity Vs Variable An...

Let's speak concerning Fixed Annuities versus variable annuities, which I love to speak regarding. Now, please note, I don't market variable annuities. I market contractual guarantees.

All right, I'm going to explain annuities. That better to explain annuities than America's annuity representative, Stan The Annuity Male.

I will call them shared funds since assumption what? Variable annuities sold out in the hinterland are among the most preferred annuities. Now, variable annuities were put on the planet in the '50s for tax-deferred growth, and that's superb.

I understand, however I would certainly claim that in between 2% to 3% typically is what you'll locate with a variable annuity cost for the policy's life. Every year, you're stuck starting at minus 2 or minus 3, whatever those expenditures are.

Analyzing Fixed Vs Variable Annuity Pros Cons A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Income Annuity Vs Variable Annuity Pros and Cons of What Is A Variable Annuity Vs A Fixed Annuity Why Fixed Annuity Or Variable Annuity Can Impact Your Future Variable Annuities Vs Fixed Annuities: Simplified Key Differences Between Fixed Vs Variable Annuity Pros And Cons Understanding the Key Features of Fixed Annuity Vs Equity-linked Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Interest Annuity Vs Variable Investment Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Deferred Annuity Vs Variable Annuity

Now, they're not dreadful items. I imply, you can connect income cyclists to variable annuities. We have actually located that earnings cyclists connected to dealt with annuities generally provide a higher contractual assurance. Yet variable annuities are too great to be a real sales pitch. Market growth, and you can attach warranties, and so on.

And once more, disclaimer, I do not offer variable annuities, however I know a lot concerning them from my previous life. There are no-load variable annuities, which means that you're fluid on day one and pay a very small reduced, reduced, low fee. Typically, you manage it yourself. Some no-load variable annuities are around that advisors can manage for a fee.

Understanding Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at How Retirement Planning Works Defining Fixed Vs Variable Annuity Features of Fixed Annuity Or Variable Annuity Why Fixed Vs Variable Annuity Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Fixed Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at What Is A Variable Annuity Vs A Fixed Annuity

If you're going to claim, "Stan, I have to acquire a variable annuity," I would certainly say, go purchase a no-load variable annuity, and have a professional cash supervisor take care of those separate accounts internally for you. But when again, there are limitations on the options. There are constraints on the options of shared funds, i.e., different accounts.

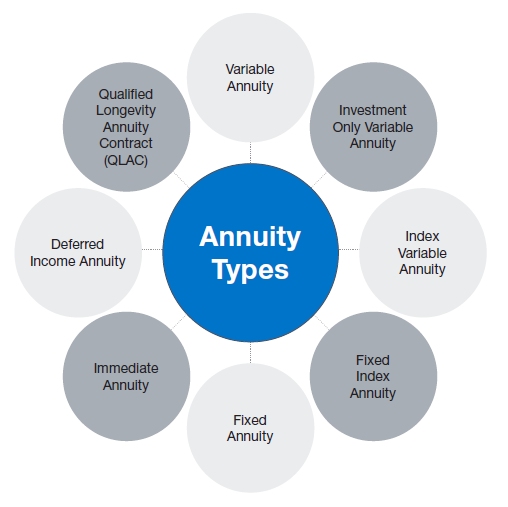

I mean, those are the various kinds. So it's hard to compare one Fixed Annuity, a prompt annuity, to a variable annuity since an instant annuity's are for a lifetime earnings. A variable annuity could be for growth or should be for development, supposed growth, or minimal development, alright? Very same thing to the Deferred Revenue Annuity and Qualified Durability Annuity Contract.

Those are pension items. Those are transfer threat items that will certainly pay you or pay you and a partner for as long as you are taking a breath. I assume that the much better correlation for me to contrast is looking at the set index annuity and the Multi-Year Guarantee Annuity, which by the way, are provided at the state degree.

Currently, the problem we're facing in the market is that the indexed annuity sales pitch appears strangely like the variable annuity sales pitch but with principal defense. And you're out there going, "Wait, that's specifically what I want, Stan The Annuity Guy. That's precisely the item I was trying to find.

Index annuities are CD items released at the state degree. Okay? Period. End of tale. They were placed on the earth in 1995 to complete with regular CD prices. And in this world, regular MYGA dealt with prices. That's the sort of 2 to 4% world you're looking at. And there are a great deal of people that call me, and I got a call the other day, this is a great instance.

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Annuities Variable Vs Fixed Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Retirement Income Fixed Vs Variable Annuity Understanding the Risks of Long-Term Investments Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing Fixed Annuity Or Variable Annuity FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing Tax Benefits Of Fixed Vs Variable Annuities Financial Planning Simplified: Understanding Annuities Variable Vs Fixed A Beginner’s Guide to Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at Fixed Vs Variable Annuity

The individual said I was going to get 6 to 9% returns. And I'm like, "Well, the great news is you're never ever going to lose cash.

Allow's simply claim that. And so I resembled, "There's very little you can do due to the fact that it was a 10-year item on the index annuity, which suggests there are surrender charges."And I always inform individuals with index annuities that have the one-year call choice, and you acquire a 10-year surrender fee item, you're acquiring an one-year warranty with a 10-year surrender charge.

Index annuities versus variable. The annuity sector's version of a CD is currently a Multi-Year Assurance Annuity, contrasted to a variable annuity.

And when do you desire those contractual assurances to begin? That's where taken care of annuities come in.

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future What Is Indexed Annuity Vs Fixed Annuity? Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Variable Annuity Vs Fixed Annuity Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Deferred Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Vs Fixed Annuities

Ideally, that will certainly transform because the sector will make some adjustments. I see some innovative items coming for the signed up financial investment advisor in the variable annuity world, and I'm going to wait and see just how that all shakes out. Never ever neglect to live in reality, not the dream, with annuities and legal assurances!

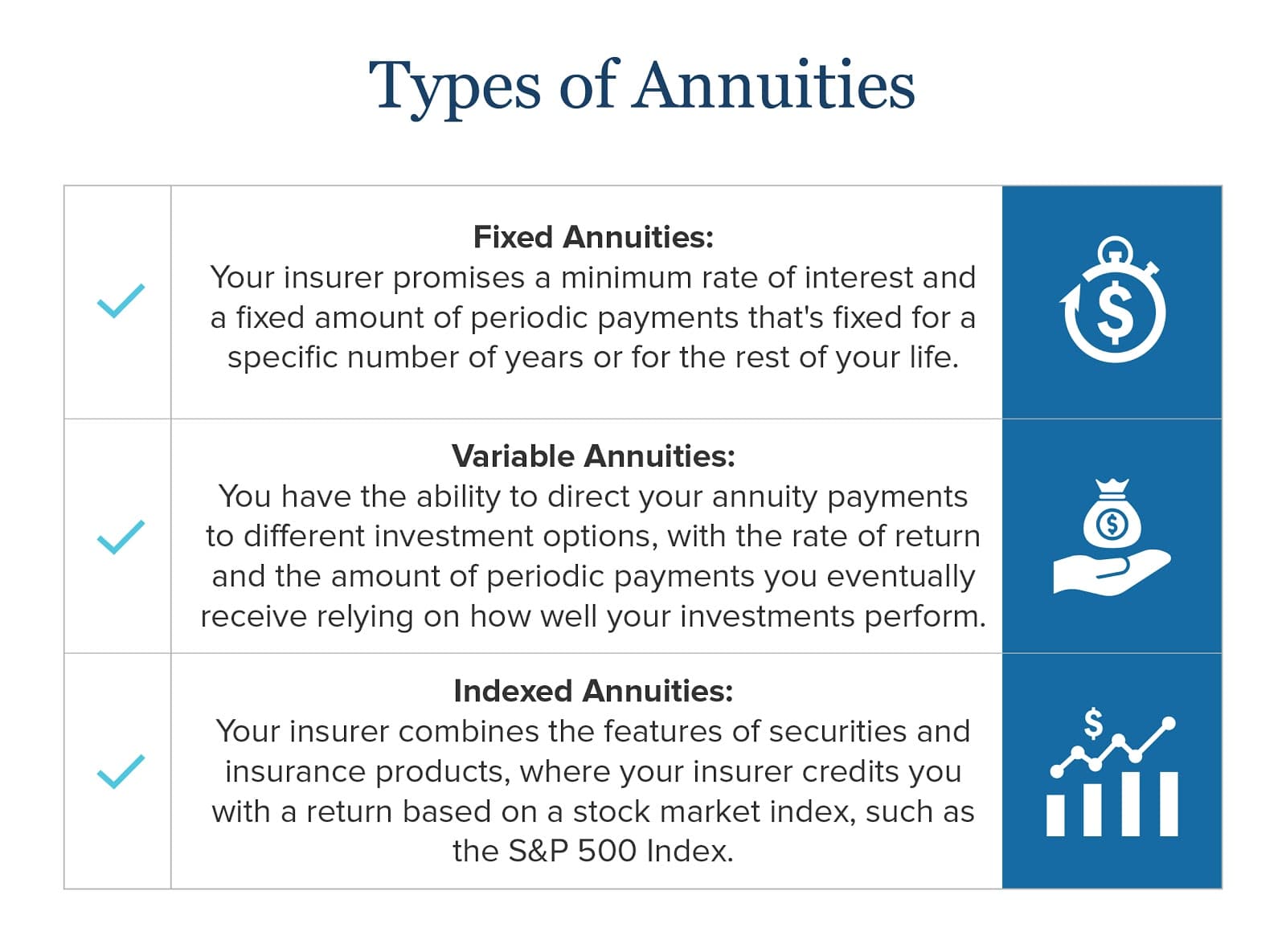

Annuities are a kind of investment item that is typically used for retirement planning. They can be explained as agreements that supply repayments to an individual, for either a details amount of time, or the rest of your life. In straightforward terms, you will invest either a single payment, or smaller regular repayments, and in exchange, you will get settlements based upon the amount you invested, plus your returns.

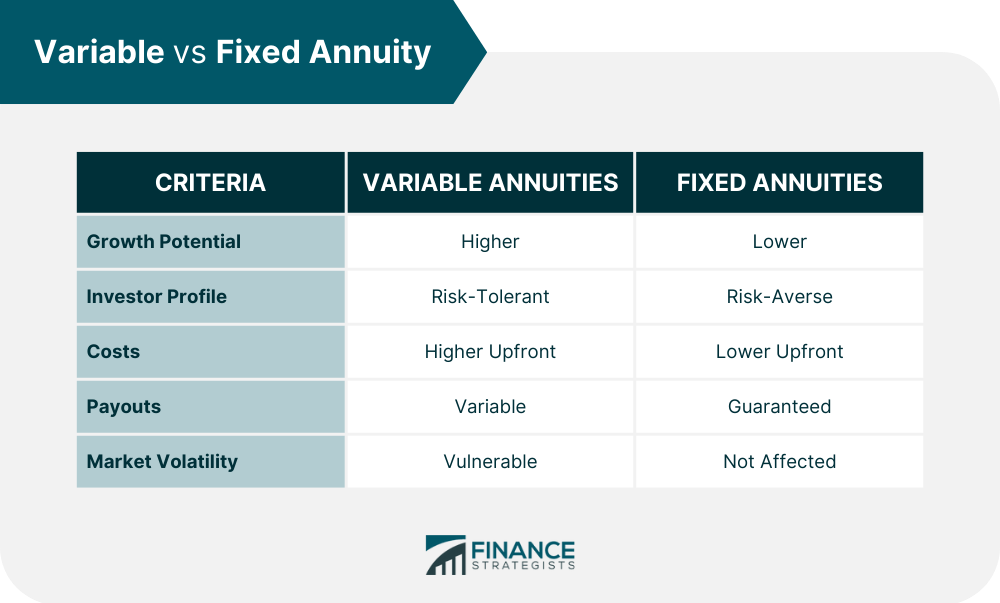

The price of return is evaluated the beginning of your agreement and will not be impacted by market changes. A fixed annuity is a fantastic choice for somebody searching for a steady and foreseeable income source. Variable Annuities Variable annuities are annuities that enable you to invest your premium into a selection of alternatives like bonds, stocks, or shared funds.

While this implies that variable annuities have the possible to supply greater returns compared to dealt with annuities, it additionally indicates your return rate can rise and fall. You might be able to make even more revenue in this situation, however you additionally run the risk of possibly shedding money. Fixed-Indexed Annuities Fixed-indexed annuities, also called equity-indexed annuities, incorporate both repaired and variable features.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Defining Annuity Fixed Vs Variable Pros and Cons of Deferred Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Is a Smart Choice Fixed Annuity Vs Equity-linked Variable Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Indexed Annuity Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Immediate Fixed Annuity Vs Variable Annuity

This offers a fixed level of earnings, in addition to the chance to make additional returns based on various other investments. While this typically secures you versus shedding revenue, it also restricts the revenues you may be able to make. This sort of annuity is a fantastic choice for those searching for some protection, and the capacity for high profits.

These financiers buy shares in the fund, and the fund invests the cash, based upon its stated objective. Shared funds include options in significant asset classes such as equities (supplies), fixed-income (bonds) and money market protections. Financiers share in the gains or losses of the fund, and returns are not ensured.

Capitalists in annuities change the danger of running out of money to the insurance policy business. Annuities are typically much more pricey than shared funds since of this feature. There are two various sort of annuities in your plan: "guaranteed" and "variable." A guaranteed annuity, such as TIAA Typical, guarantees revenue during retirement.

Both common funds and annuity accounts provide you a selection of choices for your retirement cost savings requires. Spending for retirement is just one part of preparing for your economic future it's just as important to identify exactly how you will get earnings in retirement. Annuities generally offer a lot more alternatives when it pertains to acquiring this income.

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why What Is Variable Annuity Vs Fixed Annuity Matters for Retirement Planning Fixed Annuity Vs Equity-linked Variable Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Annuities Variable Vs Fixed Who Should Consider Fixed Index Annuity Vs Variable Annuities? Tips for Choosing What Is A Variable Annuity Vs A Fixed Annuity FAQs About Fixed Income Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Vs Fixed Annuity A Beginner’s Guide to Fixed Vs Variable Annuity Pros Cons A Closer Look at How to Build a Retirement Plan

You can take lump-sum or organized withdrawals, or pick from the list below revenue choices: Single-life annuity: Deals routine advantage payments for the life of the annuity proprietor. Joint-life annuity: Deals routine benefit settlements for the life of the annuity owner and a partner. Fixed-period annuity: Pays revenue for a specified number of years.

Partial annuitization: A strategy with which you annuitize a part of your account equilibrium to produce income. The balance continues to be invested until a later day. Choosing which investment alternatives might be best for you relies on your special economic scenario and your retirement revenue objectives. For aid in developing an investment strategy, telephone call TIAA at 800 842-2252, Monday through Friday, 8 a.m.

Capitalists in deferred annuities make routine investments to build up the large sum, after which the settlements begin. This is a good way to fund the university education of a child or grandchild. Nonetheless, annuities are usually used for retirement. Obtain fast response to your annuity concerns: Call 800-872-6684 (9-5 EST) What is the difference between a fixed annuity and a variable annuity? Fixed annuities pay the same quantity monthly, while variable annuities pay an amount that relies on the financial investment efficiency of the investments held by the particular annuity.

Why would certainly you want an annuity? Tax-Advantaged Investing: When funds are purchased an annuity (within a retirement, or not) growth of resources, rewards and rate of interest are all tax obligation deferred. Investments right into annuities can be either tax obligation insurance deductible or non-tax deductible contributions depending upon whether the annuity is within a retirement or otherwise.

Distributions from annuities spent for by tax obligation insurance deductible contributions are completely taxed at the recipient's then existing income tax obligation rate. Distributions from annuities paid for by non-tax deductible funds are subject to unique treatment because some of the routine settlement is in fact a return of resources invested and this is not taxable, just the interest or investment gain portion is taxed at the recipient's after that existing income tax rate.

Analyzing Fixed Index Annuity Vs Variable Annuities Key Insights on Annuities Fixed Vs Variable What Is the Best Retirement Option? Features of Variable Annuities Vs Fixed Annuities Why Choosing the Right Financial Strategy Is Worth Considering Deferred Annuity Vs Variable Annuity: Simplified Key Differences Between Fixed Annuity Vs Equity-linked Variable Annuity Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Vs Variable Annuities? Tips for Choosing the Best Investment Strategy FAQs About Fixed Income Annuity Vs Variable Growth Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Interest Annuity Vs Variable Investment Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

(For extra on tax obligations, see IRS Publication 575) I was reluctant initially to purchase an annuity on the net. When I obtained your quote report and review your evaluations I mored than happy I discovered your site. Your phone representatives were always really useful. You made the entire thing go really basic.

This is the subject of another write-up.

Table of Contents

- – Analyzing Fixed Vs Variable Annuity Pros Cons ...

- – Understanding Fixed Income Annuity Vs Variable...

- – Exploring the Basics of Retirement Options A ...

- – Highlighting Fixed Interest Annuity Vs Variab...

- – Breaking Down Your Investment Choices A Clos...

- – Analyzing Strategic Retirement Planning Key ...

- – Analyzing Fixed Index Annuity Vs Variable An...

Latest Posts

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Benefits of What Is Variable Annuity Vs

Exploring the Basics of Retirement Options Everything You Need to Know About Variable Annuity Vs Fixed Indexed Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why Ch

Breaking Down Your Investment Choices A Comprehensive Guide to What Is A Variable Annuity Vs A Fixed Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Choosing Between Fixed

More

Latest Posts