All Categories

Featured

Table of Contents

On the various other hand, if a customer requires to offer a special requirements kid that might not have the ability to manage their very own money, a trust fund can be added as a recipient, enabling the trustee to manage the distributions. The kind of recipient an annuity proprietor selects affects what the beneficiary can do with their inherited annuity and just how the proceeds will be tired.

Many contracts permit a partner to determine what to do with the annuity after the proprietor dies. A spouse can change the annuity agreement into their name, thinking all regulations and civil liberties to the preliminary arrangement and delaying immediate tax obligation repercussions (Income protection annuities). They can gather all remaining settlements and any kind of fatality benefits and choose beneficiaries

When a spouse comes to be the annuitant, the partner takes over the stream of payments. This is called a spousal continuation. This provision permits the surviving partner to preserve a tax-deferred condition and safe long-lasting economic stability. Joint and survivor annuities likewise enable a named recipient to take control of the agreement in a stream of payments, instead of a round figure.

A non-spouse can only access the assigned funds from the annuity owner's initial contract. Annuity proprietors can pick to mark a trust fund as their beneficiary.

What is the difference between an Tax-deferred Annuities and other retirement accounts?

These differences designate which beneficiary will receive the entire fatality advantage. If the annuity owner or annuitant dies and the main recipient is still to life, the primary beneficiary obtains the death advantage. If the main recipient predeceases the annuity owner or annuitant, the fatality advantage will go to the contingent annuitant when the proprietor or annuitant passes away.

The proprietor can transform beneficiaries at any time, as long as the contract does not need an irreversible beneficiary to be named. According to expert factor, Aamir M. Chalisa, "it is very important to understand the value of assigning a beneficiary, as picking the incorrect recipient can have serious consequences. A number of our customers select to name their minor children as beneficiaries, commonly as the key recipients in the absence of a spouse.

Proprietors that are married need to not presume their annuity instantly passes to their spouse. When picking a beneficiary, think about elements such as your connection with the person, their age and just how inheriting your annuity may affect their financial scenario.

The beneficiary's partnership to the annuitant usually identifies the policies they comply with. A spousal recipient has more choices for dealing with an acquired annuity and is treated even more leniently with tax than a non-spouse beneficiary, such as a kid or various other household participant. Intend the owner does make a decision to call a kid or grandchild as a recipient to their annuity

Is there a budget-friendly Annuity Investment option?

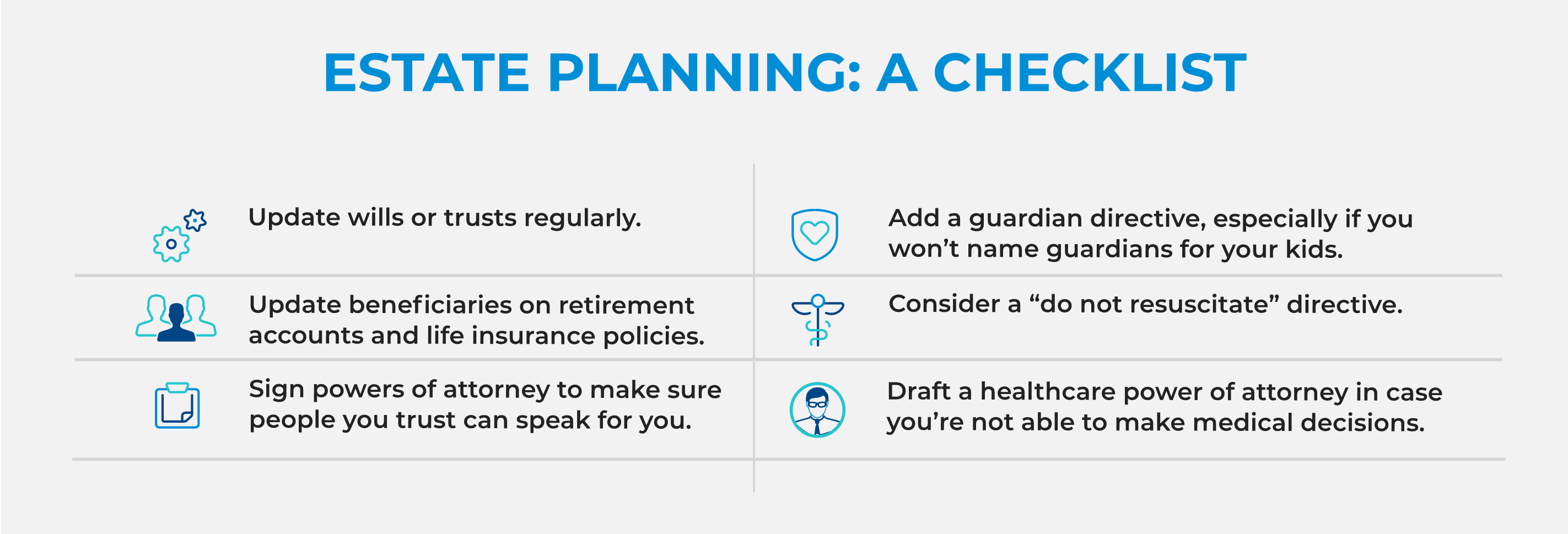

In estate planning, a per stirpes designation defines that, must your beneficiary die before you do, the recipient's descendants (youngsters, grandchildren, et cetera) will certainly receive the death advantage. Link with an annuity expert. After you've chosen and named your beneficiary or beneficiaries, you need to continue to assess your selections at least annually.

Keeping your classifications up to date can ensure that your annuity will certainly be managed according to your wishes need to you pass away all of a sudden. An annual testimonial, major life events can prompt annuity owners to take an additional appearance at their beneficiary options.

Is there a budget-friendly Lifetime Income Annuities option?

Just like any kind of monetary product, seeking the aid of a financial advisor can be helpful. A financial planner can lead you with annuity management processes, consisting of the approaches for updating your agreement's recipient. If no beneficiary is called, the payment of an annuity's survivor benefit goes to the estate of the annuity holder.

To make Wealthtender totally free for visitors, we earn cash from marketers, consisting of monetary experts and companies that pay to be featured. This develops a dispute of rate of interest when we prefer their promo over others. Wealthtender is not a client of these monetary solutions companies.

As a writer, it is among the very best praises you can provide me. And though I truly appreciate any one of you investing some of your active days reviewing what I create, clapping for my article, and/or leaving appreciation in a remark, asking me to cover a topic for you truly makes my day.

It's you stating you trust me to cover a subject that is essential for you, and that you're confident I would certainly do so better than what you can currently discover online. Pretty heady things, and a responsibility I do not take likely. If I'm not accustomed to the topic, I investigate it on the internet and/or with get in touches with that know more about it than I do.

What is the process for withdrawing from an Fixed-term Annuities?

In my friend's case, she was thinking it would be an insurance plan of sorts if she ever before enters into nursing home care. Can you cover annuities in a post?" So, are annuities a valid referral, an intelligent relocation to protect guaranteed income permanently? Or are they an underhanded advisor's method of wooling unwary customers by encouraging them to move assets from their profile right into a challenging insurance policy item pestered by too much costs? In the most basic terms, an annuity is an insurance product (that only licensed representatives may market) that assures you month-to-month settlements.

This generally applies to variable annuities. The more bikers you tack on, and the much less risk you're eager to take, the lower the payments you must expect to get for a given costs.

What is an Deferred Annuities?

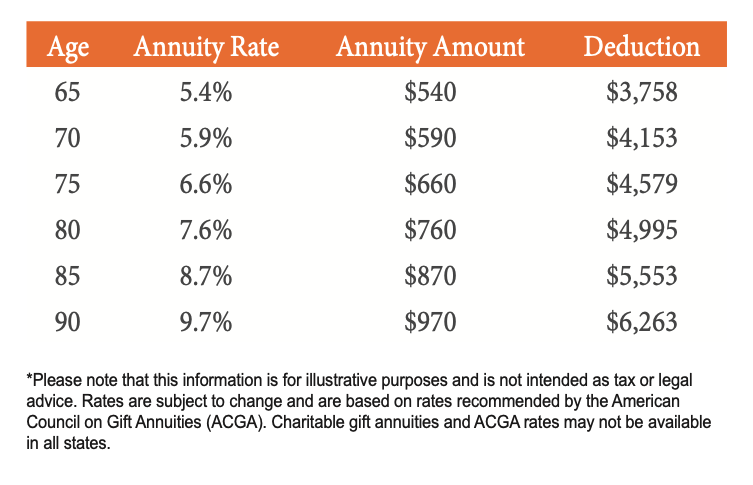

Annuities selected properly are the appropriate selection for some people in some scenarios., and then number out if any annuity option offers enough benefits to justify the costs. I made use of the calculator on 5/26/2022 to see what an instant annuity may payment for a solitary costs of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Benefits of What Is Variable Annuity Vs

Exploring the Basics of Retirement Options Everything You Need to Know About Variable Annuity Vs Fixed Indexed Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why Ch

Breaking Down Your Investment Choices A Comprehensive Guide to What Is A Variable Annuity Vs A Fixed Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Choosing Between Fixed

More

Latest Posts